Results of the June 2025 Survey on credit terms and conditions in euro-denominated securities financing and OTC derivatives markets (SESFOD)

31 July 2025

- Price and non-price credit terms and conditions remained largely unchanged between March 2025 and May 2025, tightening slightly for certain counterparty types

- Demand for lending against collateral and financing rates/spreads increased across all asset classes except equities

- Tariff turmoil in April 2025 had a limited but slightly negative impact on bank clients’ ability to meet margin calls

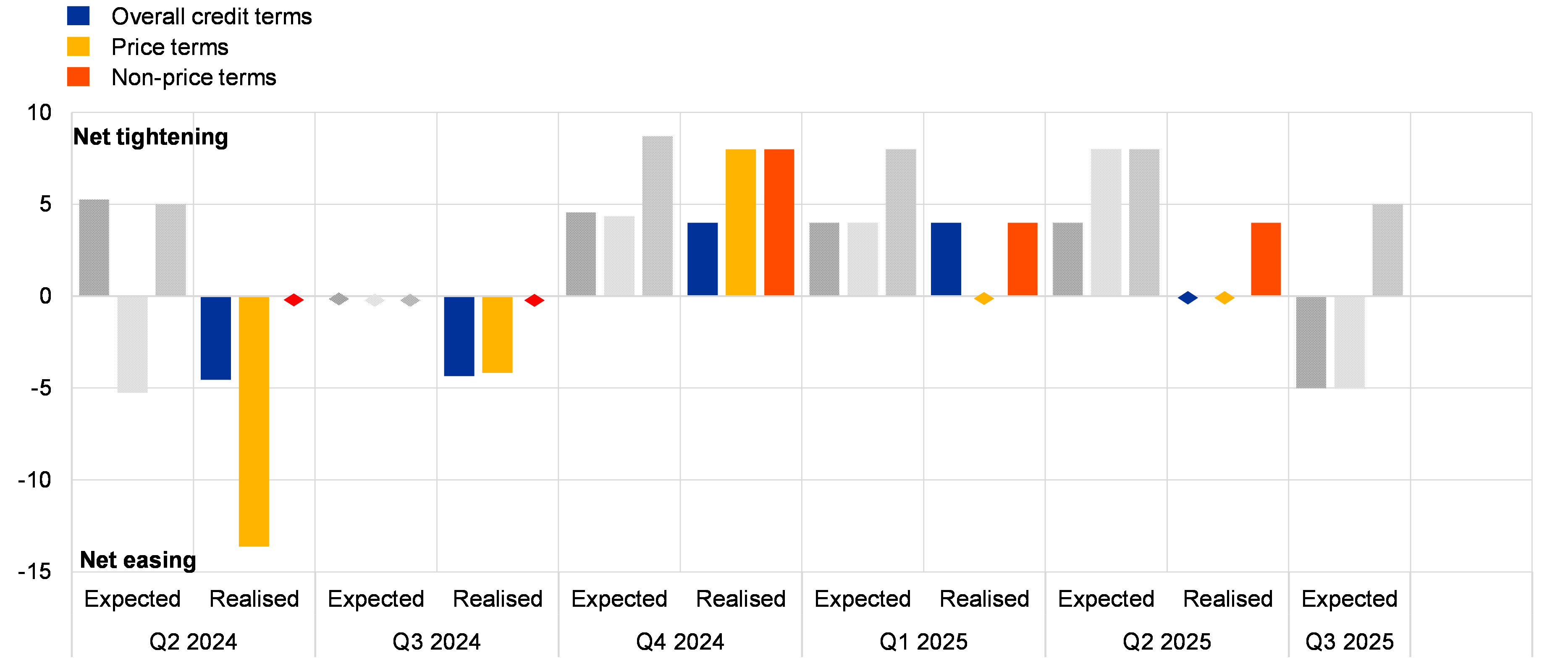

Price and non-price credit terms and conditions remained largely unchanged between March 2025 and May 2025, with a slight tightening of non-price terms across banks and dealers, non-financial corporations and sovereigns. For price terms, survey responses indicated no net change. General market liquidity and functioning was most frequently cited as the primary driver behind tightening. Looking ahead, some survey respondents expect credit terms and conditions to ease slightly in the third quarter of 2025. However, the vast majority (86%) stated that, overall, no changes were foreseen (Chart 1).

Chart 1

Expected and realised quarterly changes in overall credit terms and price/non-price terms offered to counterparties across all transaction types

(net percentages of survey respondents)

Source: ECB.

Note: Net percentages are calculated as the difference between the percentage of respondents reporting “tightened somewhat” or “tightened considerably” and the percentage reporting “eased somewhat” or “eased considerably”.

Turning to financing conditions for funding secured against the various types of collateral, financing rates/spreads increased across nearly all collateral types except equities for both average and most-favoured clients, reversing the decline observed in the preceding quarter. Furthermore, respondents indicated that demand for funding secured against any type of collateral except equities increased in the most recent period (Chart 2). Maximum maturities of funding decreased slightly for most collateral types, especially for government bonds, with only high-quality, non-financial corporate bonds showing a small net increase.

Chart 2

Securities financing transactions experienced an increase in financing rates/spreads and demand for funding, except for equities

a) Change in financing rates/spreads for average clients by collateral type |

b) Change in overall demand for term funding by collateral type |

|---|---|

(net percentages of survey respondents, inverted) |

(net percentages of survey respondents, inverted) |

|

|

Note: Net percentages are calculated as the difference between the percentage of respondents reporting “decreased somewhat” or “decreased considerably” and the percentage reporting “increased somewhat” or “increased considerably”.

Against the background of broadly unchanged credit terms and conditions for the various types of non-centrally cleared over-the-counter (OTC) derivatives, including initial margin requirements, survey respondents pointed out a few changes regarding credit limits, liquidity and valuation disputes. The volume of valuation disputes increased for a few types of derivatives, particularly foreign exchange derivatives and credit derivatives referencing structured credit products. The maximum allowed exposure decreased for interest rate and commodity derivatives, while it increased slightly for credit derivatives. This was paired with reported improvements in the liquidity and trading of credit derivatives.

The survey found that the US tariff announcements on 2 April had a limited but slightly negative impact on clients’ ability to meet margin calls. At the same time, the announcements did not significantly increase forced asset sales. The survey also featured a set of special questions examining euro area government bond (EGB) repo market activity and trading strategies. A large majority of respondents confirmed that they had engaged in trades combining EGB repo and reverse repo transactions, with margin offsets being a common practice for these types of transactions. However, other EGB repo trades were less common, such as those in combination with EGB futures or other interest rate derivatives. Yield curve or duration trades were named the most popular trades among client hedge funds, although alternative strategies, including cash-futures basis trades and intra-euro area sovereign repo trades, were also prevalent. Moreover, the majority of respondents indicated they had conducted a material number of EGB repo or reverse repo transactions as non-CCP bilateral trades in the last year and that they also expected the share of these trades to increase further over the next year.

The results of the June 2025 SESFOD survey, the underlying detailed data series and the SESFOD guidelines are available on the ECB’s website, together with all other SESFOD publications.

The SESFOD survey is conducted four times a year and covers changes in credit terms and conditions over three-month reference periods ending in February, May, August and November. The June 2025 survey collected qualitative information on changes between March 2025 and May 2025. The results are based on the responses received from a panel of 26 large banks, comprising 14 euro area banks and 12 banks with head offices outside the euro area.

For media queries, please contact Verena Reith, tel.: +49 172 2570849.

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release