Key Trend Transformation in the Neobanking Market 2024: Innovative Neobanking Products Redefine Financial Landscape

Neobanking Global Market Report 2024 – Market Size, Trends, And Forecast 2024-2033

LONDON, GREATER LONDON, UNITED KINGDOM, November 14, 2024 /EINPresswire.com/ -- The Business Research Company’s Early Year-End Sale! Get up to 30% off detailed market research reports—limited time only!

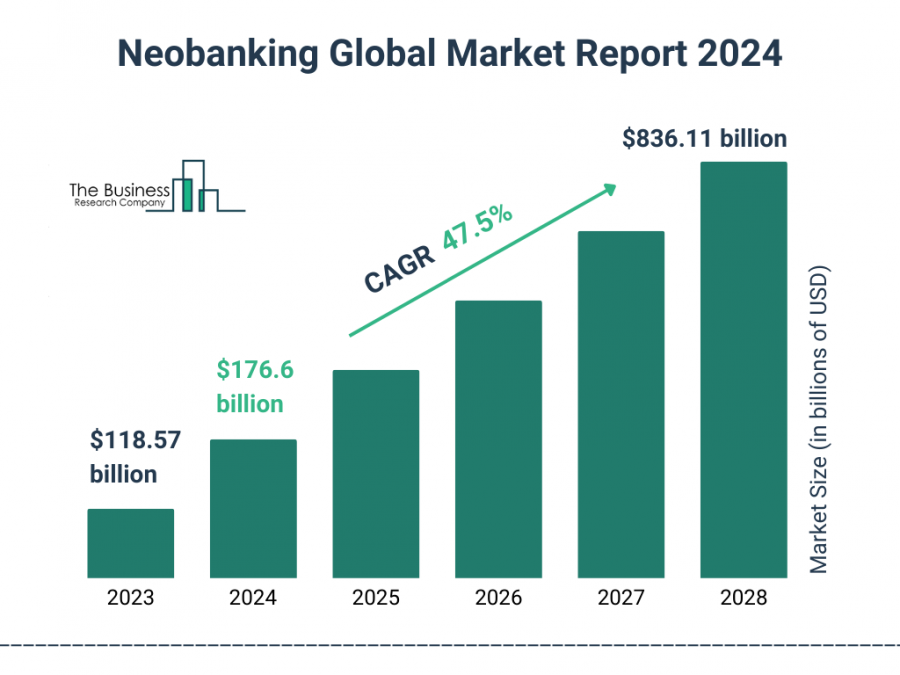

The neobanking market has surged, projected to grow from $118.57 billion in 2023 to $176.6 billion in 2024 at a CAGR of 48.9%. Key drivers include demand for convenience, regulatory adaptability, globalization, cross-border financial solutions, and the leverage of big data for financial inclusivity.

What Is the Future Market Size of the Global Neobanking Market and Its Yearly Growth Rate?

The neobanking market, forecasted to reach $836.11 billion by 2028 with a 47.5% CAGR, will grow through open banking, embedded finance, and expanded services. Trends involve open banking platform integration, fintech partnerships, AI-driven finance, and contactless banking innovations.

Access a Comprehensive Sample Report for Exclusive Insights Into the Global Neobanking Market:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7061&type=smp

What Are The Primary Growth Drivers Of The Neobanking Market?

The neobanking global market is expanding as global banking institutions increasingly adopt digitalization. Digital banking replaces physical bank locations with a continuous online presence, automating traditional financial services. Neobanks enable online banking operations without physical branches, offering digitalized banking services with AI, automation, and cloud computing to provide personalized services at lower costs.

Pre-book the report for a swift delivery:

https://www.thebusinessresearchcompany.com/report/neobanking-global-market-report

Who Are The Top Market Players Contributing To The Growth Of The Neobanking Market?

Major companies operating in the market report are Wells Fargo & Company, U.S. Bancorp, TD Ameritrade Holding Corporation, Webank Inc., Nubank, Chime Financial Inc., SoFi Technologies Inc., Green Dot Corporation, Robinhood Markets Inc., Revolut Ltd., Upgrade Inc., Monzo Bank Ltd., Aspiration Inc., Tangerine Bank, N26 GmbH, Starling Bank Ltd., Personal Capital LLC, Radius Financial LLC, Ubank Limited, Betterment LLC, Bunq BV.

What Emerging Trends Are Affecting The Size Of The Neobanking Market?

Key players in the neobanking industry are introducing innovative neobanking products to expand their customer reach, boost sales, and drive revenue growth. Neobanking products encompass financial services provided by digital-only or online-based banks, known as neobanks.

How Is the Global Neobanking Market Segmented?

1) By Account Type: Business Account, Savings Account

2) By Service: Mobile Banking, Payments And Money Transfer, Checking/Savings Account, Loans, Other Services

3) By Application: Enterprises, Personal, Other Application

Geographical Analysis: Western Europe Emerges as the Neobanking Market Leader

Western Europe was the largest region in the neobanking market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is The Definition And Overview Of The Neobanking Market?

Neobanking refers to digital banks without physical locations that cater to tech-savvy customers by offering a wide range of financial services, including payments, debit cards, money transfers, and lending, with a strong emphasis on mobile and digital solutions.

The Neobanking Global Market Report 2024 from The Business Research Company includes the following key information:

• Market size data for both historical and future periods

• Analysis of both macro and microeconomic factors that have impacted the market over the past five years

• Regional market analysis covering Asia-Pacific, China, Western Europe, Eastern Europe, North America, the USA, South America, and the Middle East and Africa

• Country-specific market analysis for Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA.

Overview of the Global Neobanking Market Report: Trends, Opportunities, Strategies, and More

The Neobanking Global Market Report 2024 from The Business Research Company is an extensive resource that delivers insights into neobanking market size, neobanking market drivers and trends, neobanking global market major players, neobanking competitors' revenues, neobanking global market positioning, and neobanking market growth across geographies. This report provides valuable in-depth insights into potential opportunities and strategies. Companies can utilize the information presented to target segments with the greatest growth potential.

Browse Through More Similar Reports By The Business Research Company:

Open Banking Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/open-banking-global-market-report

Ai In Banking Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/ai-in-banking-global-market-report

Digital Banking Platform Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/digital-banking-platform-global-market-report

What Services Does The Business Research Company Offer?

The Business Research Company has published more than 15,000 reports spanning 27 industries and over 60 regions. Our research is supported by 1.5 million datasets, thorough secondary research, and unique insights gained from interviews with industry experts. We offer ongoing and customized research services, featuring a variety of specialized packages designed to meet your specific needs, such as Market Entry Research, Competitor Tracking, Supplier & Distributor Packages, and many others.

Our flagship product, the Global Market Model, serves as a leading market intelligence platform that provides comprehensive and updated forecasts to facilitate informed decision-making.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, International Organizations, Technology, World & Regional

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release