Dallas County Property Tax Protests Versus Texas-Wide

O'Connor has undertaken a thorough analysis, meticulously comparing the 2022 Harris County Property Tax Protests with property taxes across the state of Texas.

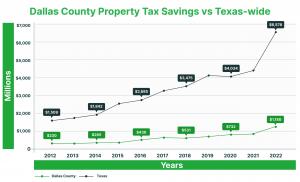

HOUSTON , TEXAS , UNITED STATES , April 18, 2024 /EINPresswire.com/ -- According to the most recent data on record, Dallas County has witnessed a substantial uptick in property tax savings resulting from property tax protests. Beginning at $230 million in 2012, these savings have surged to $1.179 billion by 2022, demonstrating an impressive 412% growth over the specified period. Similarly, statewide property tax savings have experienced a significant rise, climbing from $1.509 billion in 2012 to a notable $6,578 billion in 2022, reflecting a substantial 335% increase.

Dallas County Tax Protest Property Tax Savings

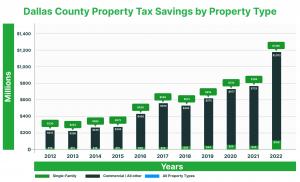

Commercial property owners significantly contributed to the increase in property tax savings resulting from protests in Dallas County. Savings for these property owners surged from $211.6 million in 2012 to $1.071 billion in 2022, marking a remarkable 406% increase. Meanwhile, property tax savings for Dallas County homeowners saw a notable rise from $18.6 million in 2012 to $108 million in 2021, representing a significant 480% increase over the same period.

Texas Tax Protest Property Tax Savings

Across the state, property tax savings for residential properties experienced a notable surge, escalating from $251 million in 2012 to $1.375 billion in 2022, representing a significant 447% increase. Likewise, savings from commercial property owners saw a substantial rise, climbing from $1.258 billion in 2012 to $5.202 billion in 2022, reflecting a noteworthy 313% increase. The utilization of appeal rights by property owners leads to billions of dollars in annual savings on property taxes.

Are Tax Protests Worthwhile?

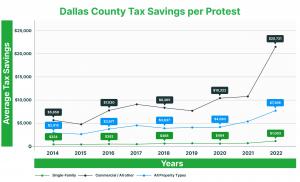

Dallas County homeowners who participated in protests achieved average savings of $1,003, compared to statewide savings of $1,093 from informal/ARB hearings. For Dallas County commercial property owners, average savings amounted to $20,730 in 2022, contrasting with $5,606 per commercial tax protest statewide. Engaging in tax protests proves to be worthwhile, with substantial savings. It is advisable to protest annually to attain optimal results and consider proceeding to the binding arbitration/judicial appeal phase when financially feasible.

Are the Benefits of Protests Spread Equally?

The benefits of protesting property taxes are primarily skewed toward commercial property owners, as fewer homeowners engage in protests. Less than 10% of Texas homeowners participate in protests. Statewide, property owners experience a reduction in 80 to 90% of informal property tax protests during the informal hearing process. Similar odds are observed in Dallas County, where homeowners see reductions in 85 to 95% of informal protests for houses during the informal hearing.

Dallas County was not the Global Leader in Tax Protests

The Dallas Central Appraisal District ranks third among all appraisal districts in terms of property tax objections. In 2022, HCAD documented 495,130 tax protests, followed by TAD with 197,120 protests, and then DCAD with 159,490 tax protests, based on the most recent year’s available statistics. It’s important to note that while these figures are significant, the statewide property tax objections for 2022 stand at 2,712,970, far surpassing the numbers reported for the individual counties mentioned above.

Dallas County Protest Rate High

In recent years, protests have been filed against 19% of tax properties in Dallas County, marking an increase from 11% in 2014. Owner protests of tax parcels in Dallas County rose to 18.77% of all properties in 2022. Across Texas, this figure increased from 6.5% in 2014 to 12.2% in 2022. Additionally, in 2022, Travis and Bexar Counties had the highest percentage of accounts protesting, with Travis at 36.9% and Bexar at 24.3%.

Dallas County Tax Protests versus Statewide

In 2022, the statewide protest rate surged to 12.2%, with 2,191,000 tax parcels contested out of 20,960,000. This marks a significant escalation from the 6.5% protest rate observed in 2014. In Dallas County, out of 849,820 accounts, 159,490 were protested in 2022, signifying a notable increase from 11.08% to 18.77% since 2014. Dallas County’s property tax protests accounted for 4% of statewide tax protests in 2022.

Dallas County Property Tax Protest Assessment Reduction

In Dallas County, property tax protest assessment reductions underwent a substantial surge, escalating from $8.53 billion in 2012 to $43.7 billion in 2022, signifying a remarkable 412% increase. Similarly, across Texas, property tax protest assessment reductions surged from $55.9 billion in 2012 to $243.6 billion in 2022, marking a significant 335% rise. These reductions encompass outcomes from informal hearings, appraisal review board hearings, and judicial appeals. However, data for assessment reduction from binding arbitration is currently unavailable.

Assessment Reduction by Stage

Property taxes can be reduced at an informal hearing, appraisal review board hearing or in binding arbitration / judicial appeal. Texas indeed has one Tax Code that includes the process for valuing property and tax protests. In practice, rules and processes vary for a variety of reasons. Some appraisal districts prefer to resolve most protests in the informal hearing process. At the other end of the spectrum, some appraisal districts are reluctant to settle at the informal or appraisal review board and effectively push accounts into either binding arbitration or a judicial appeal.

Assessment reductions at both the informal hearing and judicial appeal stages have seen significant growth. From 2012 to 2022, assessment reductions during informal hearings surged from $4.91 billion to $21.05 billion, marking a substantial 328% increase. Similarly, assessment reductions achieved through judicial appeals rose from $920 million to $3.82 billion, representing a notable 315% incline. Meanwhile, assessment reductions at the Appraisal Review Board (ARB) stage increased from $2.71 billion to $18.83 billion, demonstrating a remarkable 594% increase over the same period.

Dallas County Resolves Most Single-Family Accounts at the Informal Hearing

Here are insights into the stages of the protest process where assessment reductions occur, both in Dallas County and statewide. In Dallas County, assessment reductions are distributed as follows: 48% during informal hearings, 43% during Appraisal Review Board (ARB) hearings, and 9% through judicial appeals. Statewide, assessment reductions are allocated as follows: 46% during informal hearings, 40% during ARB hearings, and 14% through judicial appeal reductions. Notably, judicial appeals are often an overlooked strategy for property tax reduction. In Dallas County, property owners receive a larger proportion of tax reduction during informal hearings compared to the ARB or judicial appeals. Furthermore, the volume of savings from judicial appeals in Dallas County has exhibited modest growth.

Are Informal Hearings Worth It at DCAD?

In Dallas County, the success rate for informal settlements ranges from 50% to 85%, with a reduction in value included in the majority of cases. Statewide, the success rate at informal hearings stands at about 80%. Homeowners tend to have higher success rates compared to commercial property owners, both in Dallas County and across Texas. In Dallas County, informal protests for homeowners see success rates between 70% and 90%, while for commercial property owners, it ranges from 50% to 70%. Similarly, statewide, approximately 80% of homeowner informal protests result in a reduction, compared to about 62% for commercial property owners. The property tax protest success rates in Dallas County closely resemble those observed statewide.

Are ARB Hearings Worth It?

In 2022, Dallas County’s ARB hearings have shown a higher likelihood of resulting in reductions compared to statewide outcomes. About 70% of protest hearings in Dallas County lead to a reduction in value, encompassing 71% of single-family properties and 67% of commercial properties. These rates closely mirror statewide results reported by appraisal districts. Statewide, the success rate at appraisal review boards stands at 57% overall, with 61% for single-family properties and approximately 49% for commercial property protests. Interestingly, the success rate for property tax protests at the ARB in Dallas County aligns with the state for residential properties but surpasses the state average for commercial property hearings.

Options after the Appraisal Review Board (ARB)

Following the ARB, property owners have four options: 1) pursue binding arbitration, 2) engage the State Office of Administrative Hearings (SOAH), 3) pursue a judicial appeal (lawsuit in county district court), or 4) take no action. While there is a significant volume of filings for binding arbitration and judicial appeals, there are relatively few cases taken to SOAH. Most binding arbitration cases are resolved without a formal hearing.

Surprisingly, a lot of property owners choose to take no further action after the ARB. We believe that many accounts warrant appeals at the binding arbitration and judicial appeal levels. Understanding the nuances of the process can significantly benefit property owners who opt to pursue the complete protest process.

Taxpayer tip: Make it a habit to protest your property taxes every year and pursue the appeal process until you achieve the best possible outcome. This should be repeated annually. It’s worth noting that most tax protests are successful in most years across most appraisal districts. While many protests can be resolved at the informal hearing stage, some properties pose greater valuation challenges than others. Additionally, certain properties may include intangible value components that require careful consideration. For instance, the business enterprise value of a hotel or the credit rating of a lease guarantor are examples of intangible value that may need to be accounted for separately in the total valuation.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.